My stock portfolio is built around one central thesis - the digitalization of our world. I believe that,

The digitalization of our world is 10% complete.

This megatrend will continue for at least another decade.

I believe that this trend allows for outsized returns. That's why I invest a significant portion of my net worth into individual stocks. If you're interested in my monthly portfolio performance, deep-dives, and analysis around my holdings, feel free to subscribe below!

While everyone is engaged with the election and upcoming results, I have just one thing to say.

Neither side will stop the digitalization of our world. My portfolio should do well under either side, and there’s no point in using my precious time to worry about whether Democrats or Republicans are more favorable for stock market returns.

October was a volatile month. In the first half of the month, we were up almost 10% before it all came crashing down towards the end of it.

I am quite happy with that development, as it means that momentum traders have been flushed out of some of the companies that I won, Fastly being one example.

We ended up with a flat month, down 0.6%. The Nasdaq was down 1.6%, so we had a decent outperformance to show for our individual stock picking efforts.

Portfolio & Performance YTD

Portfolio: +32.94%

Nasdaq: +23.57%

All World Index: -5.36%

I want to share two links that allow you to invest alongside me.

Wikifolio:

If you are based in Germany, Austria, or Switzerland, then you can follow my Wikifolio. Once I publicize it, it would allow you to purchase a certificate through your broker that tracks my performance. Right now, you can watch it and can indicate whether you would be interested in investing.

EToro

My EToro portfolio, click here.

If you are based in Europe and are a user of EToro, you can copy my portfolio. This replicates all of my trades in your portfolio. Feel free to check it out if you like the thought of more free time and me doing all the work for you.

Top Performers - October

Snap reported a very strong quarter.

Total Revs were up 52% y/y to $679m. Their ARPU in North America grew a very healthy 46% y/y. Compared to Facebook, their ARPU is still small. New products for advertisers will increase this number quite quickly I believe. One example is the launch of “First Commercials”. This gives advertisers the very first ad and the very first product that a user sees. I think we all know how important a good first impression is, and this should be a good Ad offering.

DAU grew in all major regions, 7% in the US, 10% in Europe and 43% in Rest of World.

Gross Margins increased 7 percentages point y/y to 58%.

Evan Spiegel is still a very young CEO at just 30 years old. He has shown incredible product innovation for a couple of years now, and towards the beginning of last year, it was clear to me that the execution of those ideas is leading to success more often than not.

I believe this quarter is just the beginning of what will be a very exciting run over the next years. Don’t forget that they are reaching 90% of the Gen Z population in major countries such as the US, UK, France. They cover a huge chunk of the 13 to 34 year old demographic.

Augmented Reality, Snap Minis, a push into E-Ecommerce, TV content on Snap are just some of the exciting projects that this company is working on. Augmented reality is likely the future of immersive customer experiences like catalog browsing, trying on shoes and clothes, and also showrooms. It’s early days, but any of these initiatives could add a lot of future growth to Snap’s business case.

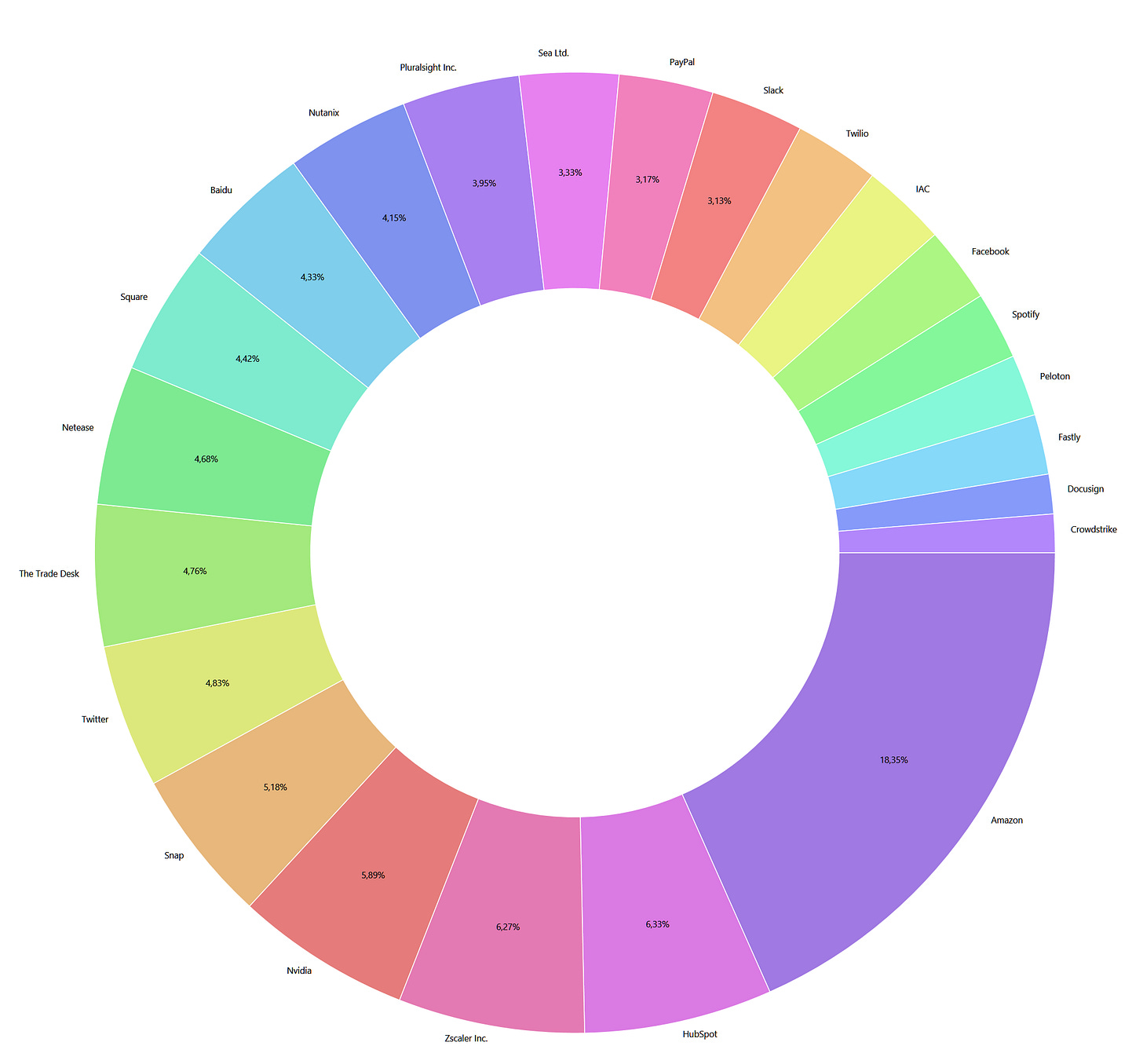

Current Portfolio - End of October

In October, I made a couple of moves.

New:

Spotify

This is a company that has grown close to my heart for a while. Watched it for many years patiently from the sidelines.

Now it is a similar case to me as Snap. It is an innovative company that has proven that it can execute repeatedly. Even though the company is valued more expensively now than in the past, I feel more confident about my investment in it at this stage.

Voice speakers such as Alexa, wireless earphones such as Airpods are two product categories that are helping to bring audio experiences to many more people more regularly.

Cars are an untapped market, where the potential is clear. I’m sure most of you have ridden in an Uber, where you could choose your own music to play via Spotify. Many of you, like me, probably listen to podcasts on their commute.

The audio market is huge. 2-3 billion people, of which Spotify has a tiny fraction. It’s a duopoly with Apple. They have a vastly superior product, also compared to Amazon Music.

For the big tech companies, their audio offering is just a complement to drive sales of their more important products. For Spotify, succeeding in Audio is existential. That is why their product is so much better and needs to be better for years to come.

While the streaming of music has been largely commoditized, and it is a relatively poor business model for Spotify with low gross margins, they have “won” here. In more mature markets where they are in a strong position vs competition, they will look to push pricing as engagement continues to grow.

From here on, the options to come up with new audio experiences are vast. This is the company that will figure it out. Audio will gain importance and mind share against video streaming and gaming as a pastime to engage with.

That is my bet for the next 10 years, and as long as they continue to execute I will add to my position over time.

Twilio

Another company that is targeting developers and builders, building the infrastructure of the future from almost the ground up. Also watched it since IPO and have been impressed with their continued execution.

The logical conclusion was to open a position and add to it over time.

Lawson is Ex-Amazon and I believe it is a strong indicator of potential success if founders come out of incredibly successful companies.

Then you get quotes like this that are not just empty, shiny words.

Those words have turned into tangible outcomes as they execute strongly against their vision. Their track record is now large enough for me to go in.

The acquisition of Segment closed by now. This enables them to provide a customer engagement platform covering the entire funnel and user journey.

Twilio is powering companies in industries that are all massively benefiting from our world becoming more digital. The extremely high growth days may be over, but my conviction is high on Twilio returning attractive returns for years to come, even at today’s elevated valuations.

It’s worth checking out their latest investor day presentation if you want to understand their business in more detail.

Added:

Fastly

Not much to say here besides I am glad that the momentum traders have been flushed out for now. The stock is now at a much more attractive valuation given their future prospects.

Many investors panic at the sight of any negative news. It is silly to sell on a single piece of news, such as TikTok no longer being a customer.

If you have done the research and believe in the company, then you need to learn not to react to a single piece of news.

Twilio for what it’s worth, lost WhatsApp as a customer a couple years ago. A blip on the radar.

It is a small company, and I expect high volatility in this holding. I will continue to average in over time.

Sold:

Disney

I believe in the company and the stock. It just doesn’t fit with my overall strategy anymore of focusing on higher growth companies. As mentioned in previous write-ups, the boring part of my portfolio is covered by investment into an ETF that covers the whole world.

Also, figuring when and how the COVID impacted business lines will return to normal is not my strong point.

Porsche

Been wanting to sell for months and now raised cash. The future could be bright but the infighting between the executives, board members prevents them from executing at a much faster pace.

Taking a turnaround play into my portfolio was a mistake in hindsight. I am much better at sticking to growth companies.

Top Performers - YTD

The overall story for the year hasn’t changed much despite higher volatility in the last two months.

The portfolio is killing it across the board. I am not worried with the drops of Fastly and Spotify after my initial purchases and am being patient with Slack.

A lot of people hate Nutanix and Baidu, but I would take 25% and 10% gains in any year! Both sport attractive valuations, and are less risky picks in my opinion.

Thank you for following my investment journey. I hope you found this useful, and here's to an exciting November!

Thank you for reading!